Maximizing your push to close stronger in 2022

Every online retailer faces the same challenge as Q4 looms closer. Whether 2022 has been a boom or bust so far, you’ll need to forecast the final quarter and make some adjustments one way or the other. Each year, we help our clients prepare for and navigate these adjustments, and this year we’ve compiled our learnings to ensure no sellers suffer.

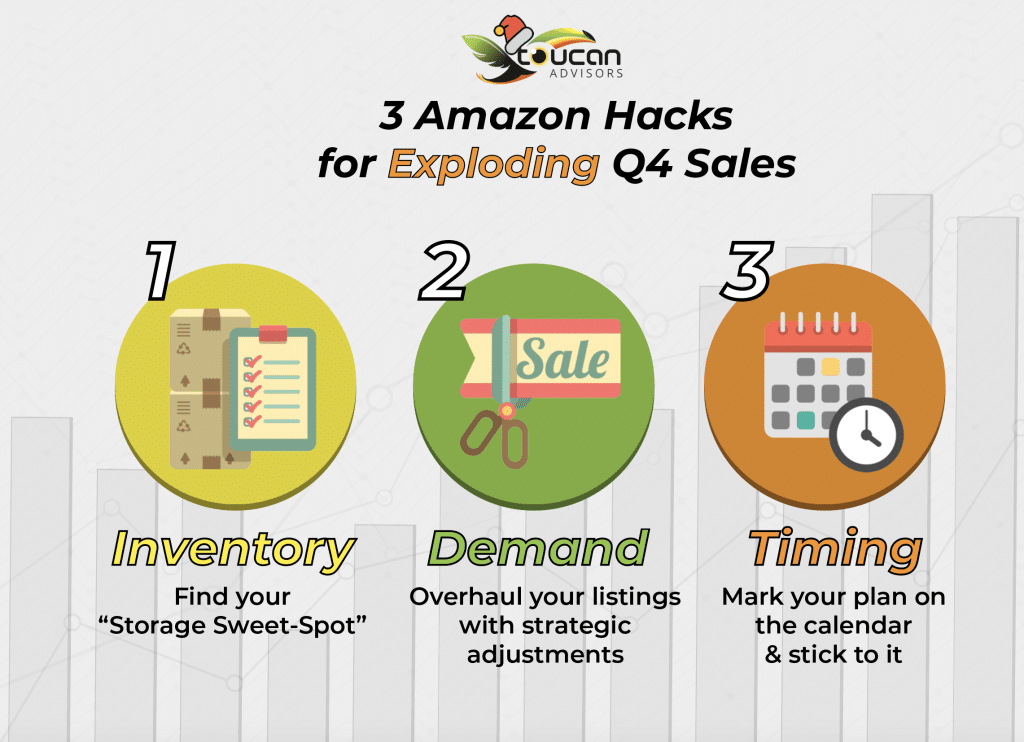

Of course, there are some factors that always exist outside your sphere of control. That’s normal. This article is meant to focus your attention on the clear, actionable elements you CAN control to optimize your sales engine and maximize revenue this holiday season: optimizing inventory, generating demand, and timing your plans wisely.

Find Your “Storage Sweet-Spot”

The importance of inventory may seem obvious, but there are nuances to how you think about it going into Q4. You’ll want to find the sweet spot of providing enough inventory to avoid going out of stock (OOS), but not so much that your product sits on the shelves of a distribution center, accruing excessive inventory fees.

Some sellers forget that Amazon storage fees increase every Q4 with the onset of the holiday season. For October – December, fees will jump up for standard size products and oversized goods. So how do you avoid racking up excessive storage costs? Start by planning your inventory in the big picture, and then “weigh” the specific products.

Plan Inventory within the Big Picture of Trends

Learn from past years as a starting point to plan and speculate for this year’s trends.

We recommend starting with a look specifically at previous Q4 trends for your products. Next, take a look at your Q1-Q3 YoY sales. Are they trending up or down? Staying flat? This trend line can help you make adjustments to your baseline as you forecast the upcoming quarter. Consider also that Q1-Q3 should account for shifts in the competitive market, weather patterns, and global factors that impact our economy (e.g., tariffs). Example — if your Q1-Q3 sales are up 30% in 2022 vs what you did on Amazon in 2021, anticipate a Q4 that will be up 30% also.

“Weighing” Specific Products

With this big-picture of how you are trending YoY and within the first three quarters of 2022, you should be able to estimate the inventory you’ll need to have on hand to fulfill orders through the holidays and into the new year. But some products perform better (and worse than others). How do you evaluate?

Reviewing a metric like Amazon’s Best Sellers Rank (BSR) to evaluate product performance can be like aiming for a constantly moving target. We recommend to our clients (and regularly assist with) granular analyses of YoY trends per each Amazon Standard Identification Number (ASIN). For example, your overall sales may be up 20%, but a particular ASIN may show Q1-Q3 growth of 20%, 27%, and 33%. This would be a strong indicator of an opportunity for a runaway boost in Q4, requiring heavier inventory stocking and possibly an investment in promos.

The insights from an ASIN analysis can also help you make projections that might defy the data. In certain cases, historic under-performance earlier in the year can be reversed in Q4 when holiday shopping takes over and consumer priorities shift slightly. This is logical for seasonal items, like mittens or snowboards, but could also apply to standard items as well.

When in doubt, we typically recommend that more is better when planning; better to eat the cost of storage than to risk going out of stock, even for those BSR-based questionable SKUs.

Create Demand for Your Products

Optimizing inventory is a passive tactic. You may improve net profit by minimizing fees, but you can find more active, aggressive opportunities to really boost your sales, too. These efforts can significantly drive your bottom line. Just think of it this way: what good is inventory if it’s not flying off the shelves?

Make-Overs for Your Product Listings

To start, we recommend reviewing your listings and freshening any product profiles you can. Look specifically at your images (e.g., with font size large enough to read on mobile), title, bullets, descriptions, and reviews.

Reviews more than anything can help you stand out and give consumers confidence in your product as they weigh it against similar competitors. How can you speak well to the negative reviews? What do you need to focus on more based on the positive reviews? Regardless, the sooner you can get those review numbers up, the more secure your position will be for the holidays. By the end of October or early November, it may already be too late. You have to improve this right now.

Consider Strategic Price Adjustments

Customers expect sales. Can you use one item to hook interest in others? Always be strategic.

One way to build momentum if your Q1-Q3 sales have trended lower than you hoped is to develop a more competitive pricing strategy. If you consider the trends of holiday shopping, you may be able to price on a rolling curve — lower initially to build momentum, higher to maximize on peak-profits, and perhaps lower again to thin your inventory after the holidays and capitalize on some last-minute shopping to boost your revenue.

Remember — Amazon and Visa gift cards are always popular gifts, and many shoppers spend them quickly, seeking post-holiday sales and promos. This is especially true for the gifts they hoped to get but didn’t find in their stockings or under a tree.

Make a Calendar to Hold Yourself Accountable

The best thing you can do after considering your Q4 plans is to write it all down. If you’ve considered inventory and worked on a plan to facilitate demand, you’ll want to ensure the pieces fit together effectively. More importantly, you’ll want to ensure your entire organization is on board and prepared to make any adjustments along the way.

Keeping a close eye on key dates can help you track your objectives and make decisions.

So, plan a midway evaluation of inventory. Given that Amazon seller help is typically much slower to receive and process shipments into FBA during Q4, and given the need to avoid going OOS, it’s likely your assessment leads you to a heavy-up on inventory numbers. However, by early- to mid-November, you should check back in to evaluate. Is it enough to make it through Black Friday and Christmas? If sales have been more aggressive than you projected, be prepared to send in more inventory by Thanksgiving.

This check-in is especially important if you run sales and promos throughout Q4 that will potentially impact your inventory projections. Conversely, you can use the inventory check-in to decide if you need to be more aggressive with your promotions, run additional PPC campaigns, or make adjustments to your pricing to drive demand. All of the tactics at your disposal are like levers you can pull; having a framework written into your calendar will ensure you have a methodical plan for which levers to pull and when, depending on how your quarter unfolds.

Accomplish Everything in a Shorter Window

If you haven’t looked ahead, you may to double check when Cyber Monday falls this year.

Don’t leave your peak-sales window up to chance. It is more critical than ever to make a plan and navigate effectively up to that holiday rush. If you have questions or want help with a focused, effective Q4 strategy and need Amazon seller help, reach out to us for a free consultation with one of our Amazon growth specialists.

Get everything in place now to give yourself the gift of a fruitful Q4. ‘Tis the season, after all.